END OF FINANCIAL YEAR

Confidential Communication

Year In Review

END OF FINANCIAL YEAR 2024

With the recent end to the 2024 financial year, we are delighted to reflect on the remarkable journey of the past twelve months at Pacific Talent Partners. This year has been filled with significant milestones, transformative achievements, and continued collaboration with our valued clients. We are excited to share a comprehensive overview of our key accomplishments, insights into emerging market trends, and a glimpse into the future initiatives we are planning. Our collective efforts have paved the way for a prosperous year ahead.

ECONOMIC OVERVIEW & THE EXECUTIVE TALENT MARKET

GLOBAL

The Reserve Bank of Australia (RBA) is suggesting that growth in Australia’s major trading partners is likely to be moderate with inflation to be close to target by the end of 2025. They feel GDP growth across these partners will ease in 2024 to near 3% and may move slightly higher in 2025. Whilst the expected stronger growth in the United States and China is helping improve global commodity prices, the RBA feels this will be offset by downward revisions to growth in Japan, some East Asia economies and New Zealand. Expectations are that the most advanced economies will have inflation rates close to 2 per cent by the end of 2025 with a further easing in the tightness of the labour market.

AUSTRALIA

In Australia, the RBA expects growth to remain subdued as interest rate increases continue to weigh on demand. Consumption and spending by households has been weaker than their expectations, despite stronger income growth in late 2023. The levels of public spending, business investment and services exports are expected to remain high relative to recent years, but growth is forecast to slow from the high rates seen in 2023. The RBA is forecasting inflation to be within the target range in 2025. The unemployment rate was 3.8 per cent in March, which continues to be only slightly above its 50 year low of 3.5 per cent and suggests the economy is at full employment.

EXECUTIVE TALENT

At Pacific Talent Partners, we have not yet seen any real negative impact on the Australian executive talent market with demand for exceptional leaders still strong across most of our Practices and Industries. This is despite many of the non-executive recruitment firms recently announcing significant declines in revenues, softening activity levels and challenging market conditions. Leaders that can inspire, motivate and deliver outcomes continue to be highly sought after and we are not expecting this to change over the medium term.

Our clients continue to remain very focused on engagement, improving productivity and operational performance.

We continue to bring in new talent into our Practices to support the increasing demand for our services and accordingly expect to continue to grow rapidly as the year unfolds. We are also delighted to confirm the promotion of Elliot Long to Managing Partner in our Executive Search business.

OUR THANKS

On behalf of the whole team at Pacific Talent Partners, I would like to thank you, our clients, for all the support you have given us over the last twelve months and look forward to continuing to partner with you in the future. As ever, please feel free to reach out to me, Elliot or to our team should you need any support or advice.

Phillip Guest CA FAICD

Founder & Chief Executive Officer

KEY ACHIEVEMENTS

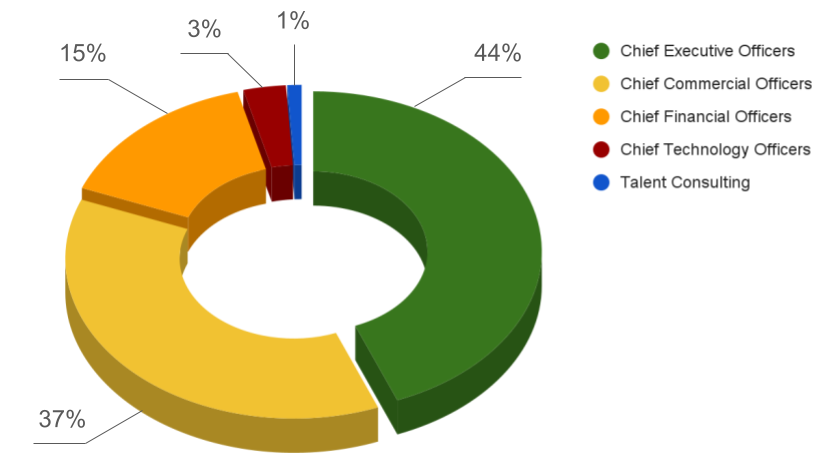

PRACTICE MIX

Our Australian and global clients continue to have an ever increasing demand for high quality leaders and leadership skills to ensure they capitalise on the many opportunities and challenges their organisations face. These include driving growth, reinforcing their distinctive capability, digitisation, artificial intelligence, energy transition, talent development and navigating geopolitical and macroeconomic volatility. This demand has been particularly strong in both our Chief Executive Officer Practice and our Chief Commercial Officer Practice, as highlighted below.

CLIENT PARTNERSHIPS

Our success is built on service excellence and the strong and lasting partnerships we forge with our clients. As we reflect on this past year, and accepting that much of our work is highly confidential in nature, we are proud to showcase a selection of some of the leading organisations that we have had the privilege to partner with. These relationships are the cornerstone of our success.

APPOINTMENT SPOTLIGHTS

We are proud to feature a selection of the exceptional leaders that we have placed into executive roles across various functions and industries. Much of our work is private and confidential in nature but where we can, we are delighted to be able to share their success with our broad executive network. We are honoured to have played a part in these success stories and look forward to many more in the coming year.

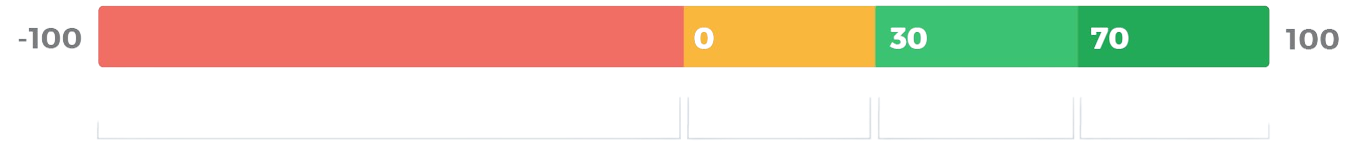

NET PROMOTER SCORE

Service excellence is central to our success and we measure that using the Net Promoter Score (NPS) methodology - the gold standard of customer experience. This financial year our NPS result is 75.5%. We are very proud of our team's efforts over the year and we sincerely value the feedback. We strive to continually achieve outstanding satisfaction scores.

75.5%

Needs Improvement

-100 - 0

Good

0 - 30

Great

30 - 70

Excellent

70 - 100

SUCCESS RECORD

Our greatest achievements are measured by the success and satisfaction of our clients. We're thrilled to share some of the wonderful feedback and success stories from those we've had the privilege to work with. These testimonials are a testament to our unwavering commitment to excellence in executive search and talent consultancy. Join us in celebrating these successes and the positive impact we've made together.

Elliot exceeded my expectations in this call in what he could offer me as a candidate and his insightful assessment of my strengths.

Bronwyn

Chief People Corporate Services Officer

They seem honest and unbiased in their assessment of candidates. The are quick to get back to you with feedback and their interview process was seamless.

Ida

Group Marketing Manager

I was extremely pleased with my conversation with William Lukabyo. He was knowledgeable, engaging, providing excellent talent market insights and advice, and gave me confidence to proceed with my search for a new role. I also was very impressed with the email and LinkedIn communications I received from Will. I now look forward to working with Will and the team at PTP to find a new role.

Geordie

Chief Commercial Officer

Services offered were well articulated. Genuine interest during meeting. Very much liked the direct networking introductions program.

Tony

Chief Financial Officer

Professional, reponsive, clearly builds genuine valued engagement and relationship, is interested in and support of a professionals career aspirations not just with the current opportunity in mind, but over the longer term

Sue

Director Strategy and Transformation

Pacif Talent Partners has a personal touch, which few other firms in the industry provides.

Annette

CEO and Founder

Good understanding of the finance space; transparent and open dialogue about the current opportunities and market condition; good approach in understanding the candidate’s background, expertise and ways of working

Teresa

Transformation Manager

I particularly valued my meeting today with Elliot Long who not only took the time to find out more deeply about my experience, but also proposed innovative ways to support me in my search for my next leadership role. I feel that today was the building of the foundations of a long term partnership between Elliot/PTP and myself. Thank you.

Justin

Marketing Director

Responding as a candidate, William and team were prompt to set up time, insightful and professional. They understand the long game of candidates being prospective clients.

Tim

Performance Manager

MARKET INSIGHTS & TRENDS

PRACTICE INSIGHTS

As industry leaders, staying ahead of market trends and emerging insights is crucial to delivering exceptional service to our clients. In this section, we share valuable observations and analysis from our team, highlighting the key trends and shifts we have witnessed over the past year. From industry dynamics to talent acquisition strategies, our team's expertise provides a comprehensive view of the market landscape.

- Chief Executive Officers

-

Market Update

Despite some economic challenges, a number of our key industry verticals remain very eager to secure capable executive-level talent and CEO’s. The primary skill that is in demand is for those with an ability to build strategy to grow revenue and profit with as little risk as possible.

We are currently supporting a number of organisations as they build succession plans for their future business leadership and are in market for CEO’s across industries such as technology services, construction materials, logistics and professional services.

We have found that churn remains higher than normal with increased scrutiny for poor financial results. Alternatively for organisations that have weathered economic challenges and taken market share, they may need new leadership as a result of growth.

Remuneration Trends

Fixed remuneration for Chief Executives has not changed materially for many years but the mix of overall remuneration has changed. We have recently seen the pleasing trend that many organisations are eager to be more transparent in the way they remunerate their Chief Executive, providing a clearer scorecard with perhaps uncapped earnings to incentivise key performance indicators.

Furthermore, in addition to short term incentives companies appear to be more eager to provide equity and ownership participation schemes for their executives to incentivise longer-term and strategic decision making, rather than quarter on quarter performance.

In summary, fixed remuneration for CEO’s has remained stable but the total ‘on target earnings’ of CEO’s has seen a slight step forward for those businesses that have been able to over-achieve in their industry sector.

Team Structures

As a result of recent ‘cost out’ transformations of many organisations, generally CEO’s have fewer resources around them to deliver on key objectives. Therefore this has led to a slightly more ‘hands-on’ style of leadership requiring CEO’s to ‘zoom in and out’ of parts of the business to solve operational issues but still keep focused on long term objectives simultaneously. In some instances, organisations have brought in more generalist leadership in finance, HR, operations and technology so that CEO’s can be better informed by their reports about where they should spend their time.

Skills in Demand

It is clear the role of the CEO continues to evolve, tracking business priorities that are reflecting the economic environment. Now more than ever we are noticing a focus on financial, sales and strategy acumen as key skillsets.

Candidate Availability

In FY2025 we have seen a shift in what is required of a CEO which seems to reflect the economy’s demands. Capital markets have slowed leading to less growth and merger & acquisition activity, shifting the types of CEO’s in demand. We are seeing more interest in those that can grow top and bottom-line results in a more traditional and risk-considered way without adding too much cost. Gone are the days of the overly entrepreneurial and unrealistically ambitious CEO’s because the downsides of making incorrect decisions are too significant in this current economic climate.

In summary, financially astute and commercially focused CEO’s are in high demand but those that can balance these capabilities are rare and not as easy to access.

Elliot Long

Chief Executive Officers - Chief Commercial Officers

-

Market Update

The demand for executive talent is increasing across industries, reflecting a competitive landscape for senior roles. There is positive growth in the commercial property and technology sectors, leading to active searches for key roles. Mid-sized clients are heavily investing in systems, technology, and workforce to gain market share against larger competitors. Despite a slight dip in consumer sentiment, stable market conditions support growth-oriented strategies. The candidate market is highly competitive due to lower unemployment rates and high demand for exceptional talent.

The executive search market is experiencing significant activity driven by several key factors. New market entrants are establishing new functions, creating demand for fresh executive roles. Internally, businesses are undertaking significant projects, necessitating the backfilling of key positions. Additionally, there is natural churn in the job market as long-term professionals seek new opportunities with the approaching financial year. The commercial sector, in particular, is demonstrating impressive resilience and adaptability, with a surge in demand for top talent across various industries. This momentum reflects growing confidence in the market’s stability and future prospects.

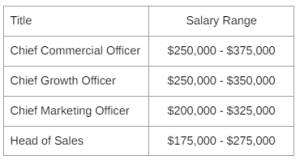

Remuneration Trends

In response to the challenging economic landscape, businesses are demonstrating a heightened willingness to motivate success by incorporating ‘at-risk’ elements into compensation structures, such as long and short-term incentives. Notably, these incentive schemes have evolved towards greater transparency, featuring objective scorecards that assess a blend of both business and individual achievements. While this practice is familiar to Commercial Leaders, it is essential to acknowledge that it often entails a reduction in the base salary component.

In the current climate, Commercial Leaders are increasingly inclined to negotiate higher remuneration, recognising the high demand for their leadership skills and their pivotal role in driving business performance. Seasoned executives, having accumulated substantial industry experience, are showing a growing inclination to transition to different sectors.

Furthermore, individuals with a background in larger corporations are now more receptive to embracing risk, considering opportunities in smaller companies with the expectation of qualifying for enhanced long-term incentives. This strategic shift reflects a broader trend among executives seeking new challenges and rewards in the evolving professional landscape.

Team Structures

Team structures across various functions are evolving to meet the demands of a growing and innovative market, particularly in the commercial property and technology sectors, leading to potential expansions in team sizes. The focus is on enhancing the skills and capabilities of sales teams, reflecting the strategic importance of these functions. The increased prominence of Chief Growth Officer (CGO) roles is notable, with CGOs playing a crucial part in driving revenue growth, understanding market opportunities, and leading cross-functional teams. Key skills for CGOs include a visionary outlook, financial literacy, collaboration, change management, and industry-specific knowledge, with sectors like electric vehicles, hospitality, manufacturing, engineering, construction, oil, real estate, and banking actively hiring CGOs.

The role of Chief Commercial Officers (CCOs) is also evolving, with increased collaboration with CMOs in order to drive company revenue, building brands, and managing vast data and IT infrastructure. Strategic thinking, data analysis, digital marketing proficiency, and leadership are key skills and qualifications for leaders, who must also focus on creating seamless omnichannel experiences and leveraging new technologies like generative AI. Future trends indicate that generative AI will disrupt marketing functions, and lead generation tactics. This indicates an important opportunity and need for teams to upskill.

Skills in Demand

The rising importance of social skills in C-suite roles is evident as companies now prioritise these abilities over traditional operational expertise. High self-awareness, effective communication, empathy, and the capacity to work with diverse groups are key social skills that are becoming essential. However, assessing these skills presents challenges, necessitating new tools and approaches such as psychometric assessments and simulation exercises.

In terms of industry trends, sectors like financial services, distribution, digital media, MedTech, and professional services remain robust, while retail and large consumer tech are experiencing quieter periods due to the RBA’s impact on consumer confidence. Currently, there is a high demand for skills related to strategic growth and technological advancement. This demand underscores a shift towards positions that drive growth and innovation within organisations. Experience and industry knowledge, especially in the commercial property and technology sectors, are highly valued, as they are crucial for navigating competitive landscapes and implementing growth-oriented strategies.

Candidate Availability

As is consistent with the market, high level executive candidates that possess incredible leadership abilities with a robust commercial acumen are difficult to source. Now that they are significantly in demand due to the changing nature of the market it is imperative that organisations are working to showcase the value of the opportunities they have available. Due to an increase in demand we are seeing that candidates are open to a lot of opportunities in faster than normal processes in what is a candidate short environment.

Alexandra Mitcherson William Lukabyo

Chief Commercial Officers Chief Commercial Officers - Chief Financial Officers

-

Market Update

Mirroring the demands of the current economic landscape, most businesses have been through a significant exercise of ‘cost out’. Large organisations are revaluing their business units and returning to core operations to ensure they have an eye on cash flow and can weather this current period before rebounding when the economy returns to growth. Of course, the key advisor to this strategy is the CFO and their ability to look at data and make decisions has been critical.

We have seen slightly less CFO movement in FY24 than in prior years, this may be as a result of the value in their insights as a partner to the CEO. Median tenures of CFO’s have stepped up slightly from just 2 years during the pandemic to 2.8 years today.

Remuneration Trends

While CFO salaries in Australia have increased by 10 to 15 per cent in the last couple of years, the slowing market indicates there will be lower increases of up to 5 per cent for senior finance roles in 2024. The earning potential of a CFO depends largely on the size of their organisation. In the year of 2023, Australia’s top 200 company CFOs saw their median salaries spike by 24 percent to A$1.44 million. At the same time, median statutory pay for the top ASX 300 CFOs increased by 9 per cent to $1.14 million. Key financial trends, such as high inflation and rising household costs, may lead many executives to seek new roles in 2024.

Long term incentive plans for CFO’s are changing, with non-financial metrics becoming more prominent. Almost 40% of ASX100 companies include non-financial metrics in their CFO incentive plans and these include environmental, social and governance targets, sustainability targets, diversity and Inclusion measures, and customer and employee satisfaction scores. We are seeing the success of a CFO be measured through a blend of financial metrics, strategic achievements, and leadership effectiveness.

Over recent years we have seen significant salary increases for those finance executives in the mid-market, including increases of up to $20,000 to $40,000. Although more recently these increases have normalised.

Team Structures

In combination with being the advisor to the CEO on returning businesses to their core offerings and managing cost, CFOs are also focussing on being advocates for the attraction and retention of key talent. It has never been more critical to be an inspirational leader to the finance team during a time when the finance team is generally leaner and relied upon for more output and insights.

An ability to utilise technology to augment reporting and insights processes has been critical with many organisations looking to their CFOs for answers on how cost can be saved through the use of advanced systems and AI. This has led to an increased collaboration between the CFO and Chief Technology Officer to work together around common business goals.

The transactional roles within finance teams continue to be automated and offshored, leaving the local finance capabilities to focus on strategy, financial planning and analysis as well as future-focused goal setting and market preparedness.

Skills in Demand

We have seen a significant shift in the required capabilities for CFOs and this is in line with the changing business priorities. In prior years many CFOs were focused on growth plans, mergers and acquisitions, new product or service launches and long-term strategies. This year has seen a refocus on internal considerations including cost and risk management, investor relations and articulating business strategy to external stakeholders. We expect this trend to continue into FY2025.

Candidate Availability

As has always been the case, the very best talent in the finance function continues to remain in high demand and very difficult to source. In FY20204 we found that those‘future-focused’ finance executives, being those with very strong forecasting, data insights and FP&A skills, have tended to be well embedded in their organisations, are less accessible and less willing to move. The key to accessing this talent has been to build a compelling career narrative and provide insights into how they can pave the foundations for their eventual step into the CFO role.

Michael Carlino

Chief Financial Officers - Chief Technology Officers

-

Market Update

As businesses attempt to navigate the current economic environment they have been more willing to incentivise success through the provision of ‘at risk’ components of salary such as long and short term incentives. These schemes have generally become more transparent with an objective scorecard that reflects a combination of business and individual success.

Executives are finishing up their projects and now it is a business as usual situation where they are not finding the work challenging enough. Those who have been working in an industry for a significant amount of time are increasingly motivated to change industries. C-Suite/Lead roles specifically in cybersecurity this year involve the building of teams which have not existed in the past or continue to build on existing teams as the risk of cybersecurity attacks increases by the minute.

Team Structures

As restructuring is occuring, many teams are becoming leaner and this is often motivated by cost cutting. This trend is apparent in organisations of various sizes. We have spoken with global companies in various sectors about this with one global healthcare company indicating their technology team was made up of under 10 people.

The blurring of lines between CIO and CTO positions are becoming more and more apparent. In the past, part of a CTOs remit has included covering part of the cybersecurity capability. Now, organisations are hiring dedicated cybersecurity specialists to cover the entire capability. Some organisations have created cybersecurity capabilities that are broken up into parts such as incident response, resilience and governance.

Blurring of lines between title use is becoming more prevalent. For example, CTO and CIO responsibilities have shifted (e.g. now companies want executives who can undertake both inward and outward facing responsibilities). Also, certain companies will have different titles for those who are at the top leadership positions such as Principals and Managing Directors.

Skills in Demand

Executives who have in-depth insight and skills in cybersecurity and artificial intelligence are highly sought after. Regarding industry, some organisations still want their leadership teams to be made up of executives coming from the same industry. However, most of our clients have an industry agnostic and function first view when bringing executives onto their leadership team.

Candidate Availability

Due to the candidate heavy market, candidates of all levels are available. Additionally, diversity is becoming even more of a focus for companies and they are ensuring that this is something that is adhered to. As such, we can provide a variety of talent to meet client needs.

Amaraj Bansal

Chief Digital & Technology Officers - Talent Consulting

-

Market Update

In the current economic climate a lot of sectors are focused on doing more with less; whether optimising performance of their workforce, downsizing or reducing cost, or looking to their leaders to drive engagement and productivity.

Talent assessment and identification – Organisations are ensuring they are clear on the behavioural capabilities needed to deliver competitive advantage, and putting in place robust and objective assessment processes to identify key talent.

Organisational design – Many companies are reviewing their organisational structures to ensure resources are effectively deployed and costs minimised. This is tending to lead to more centralised structures with a focus on standardisation and reduced duplication, rather than devolved authority and empowerment of local managers.

Leadership development – Fewer clients are designing large cohort-based leadership programs, with more interest in structured activity to build specific leadership capabilities, either with intact teams or individually through executive coaching.

Team Structures

Agile continues to gain traction with more and more organisations incorporating agile elements into their organisational structures.

Squads, tribes and chapters are increasingly common, with team and organisational structures shifting. Interestingly, while the language used often reflects agile principles, the structures and working practices are less different.

Elsewhere, the shift to skills-based operating models continues to gain lots of attention. Again though, it’s worth separating the noise from the reality; what many organisations are claiming as a transformational shift in thinking is often little more than a – very sensible – focus on defining, building and measuring relevant skills and capabilities.

Leadership Skills in Demand

Whether we call it “adaptive leadership”, “learning agility” or something else, the focus for some time has been on building small “A” agility as a key leadership capability. In simple terms, helping leaders know the questions rather than the answers will equip them to lead their organisations and teams through uncertain and fast-moving change.

Closely linked to this, we are of course seeing organisations wrestling with how to take advantage of AI and other technology advances; huge potential but still relatively untested, and while it’s a frequent conversation topic, there are few organisations yet to operationalise the technology in any meaningful or measurable way.

Key & Interesting Projects

Top team effectiveness – We have been working with the leadership team of a large government department to help them define how best to work together, lead their teams, and the department overall. This includes some individual and team assessment, executive coaching and also support onboarding new team members.

Strategy reset – Working with a large healthcare provider to onboard two acquired companies, we’re co-designing and delivering a series of strategy workshops. These are intended to help align leaders on the post-acquisition priorities and also to agree the leadership behaviours that will be key to a successful integration.

Executive coaching – At the heart of what we have done for some time, we continue to provide individual and team coaching to a series of C-suite leaders and their teams, helping define and tackle issues such as team purpose and performance, and at an individual level to set leaders up for future success in the long term.

Murray Priestman

Talent Consulting Associate

Market Update

Despite some economic challenges, a number of our key industry verticals remain very eager to secure capable executive-level talent and CEO’s. The primary skill that is in demand is for those with an ability to build strategy to grow revenue and profit with as little risk as possible.

We are currently supporting a number of organisations as they build succession plans for their future business leadership and are in market for CEO’s across industries such as technology services, construction materials, logistics and professional services.

We have found that churn remains higher than normal with increased scrutiny for poor financial results. Alternatively for organisations that have weathered economic challenges and taken market share, they may need new leadership as a result of growth.

Remuneration Trends

Fixed remuneration for Chief Executives has not changed materially for many years but the mix of overall remuneration has changed. We have recently seen the pleasing trend that many organisations are eager to be more transparent in the way they remunerate their Chief Executive, providing a clearer scorecard with perhaps uncapped earnings to incentivise key performance indicators.

Furthermore, in addition to short term incentives companies appear to be more eager to provide equity and ownership participation schemes for their executives to incentivise longer-term and strategic decision making, rather than quarter on quarter performance.

In summary, fixed remuneration for CEO’s has remained stable but the total ‘on target earnings’ of CEO’s has seen a slight step forward for those businesses that have been able to over-achieve in their industry sector.

Team Structures

As a result of recent ‘cost out’ transformations of many organisations, generally CEO’s have fewer resources around them to deliver on key objectives. Therefore this has led to a slightly more ‘hands-on’ style of leadership requiring CEO’s to ‘zoom in and out’ of parts of the business to solve operational issues but still keep focused on long term objectives simultaneously. In some instances, organisations have brought in more generalist leadership in finance, HR, operations and technology so that CEO’s can be better informed by their reports about where they should spend their time.

Skills in Demand

It is clear the role of the CEO continues to evolve, tracking business priorities that are reflecting the economic environment. Now more than ever we are noticing a focus on financial, sales and strategy acumen as key skillsets.

Candidate Availability

In FY2025 we have seen a shift in what is required of a CEO which seems to reflect the economy’s demands. Capital markets have slowed leading to less growth and merger & acquisition activity, shifting the types of CEO’s in demand. We are seeing more interest in those that can grow top and bottom-line results in a more traditional and risk-considered way without adding too much cost. Gone are the days of the overly entrepreneurial and unrealistically ambitious CEO’s because the downsides of making incorrect decisions are too significant in this current economic climate.

In summary, financially astute and commercially focused CEO’s are in high demand but those that can balance these capabilities are rare and not as easy to access.

Elliot Long

Chief Executive Officers

Market Update

The demand for executive talent is increasing across industries, reflecting a competitive landscape for senior roles. There is positive growth in the commercial property and technology sectors, leading to active searches for key roles. Mid-sized clients are heavily investing in systems, technology, and workforce to gain market share against larger competitors. Despite a slight dip in consumer sentiment, stable market conditions support growth-oriented strategies. The candidate market is highly competitive due to lower unemployment rates and high demand for exceptional talent.

The executive search market is experiencing significant activity driven by several key factors. New market entrants are establishing new functions, creating demand for fresh executive roles. Internally, businesses are undertaking significant projects, necessitating the backfilling of key positions. Additionally, there is natural churn in the job market as long-term professionals seek new opportunities with the approaching financial year. The commercial sector, in particular, is demonstrating impressive resilience and adaptability, with a surge in demand for top talent across various industries. This momentum reflects growing confidence in the market’s stability and future prospects.

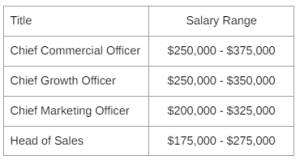

Remuneration Trends

In response to the challenging economic landscape, businesses are demonstrating a heightened willingness to motivate success by incorporating ‘at-risk’ elements into compensation structures, such as long and short-term incentives. Notably, these incentive schemes have evolved towards greater transparency, featuring objective scorecards that assess a blend of both business and individual achievements. While this practice is familiar to Commercial Leaders, it is essential to acknowledge that it often entails a reduction in the base salary component.

In the current climate, Commercial Leaders are increasingly inclined to negotiate higher remuneration, recognising the high demand for their leadership skills and their pivotal role in driving business performance. Seasoned executives, having accumulated substantial industry experience, are showing a growing inclination to transition to different sectors.

Furthermore, individuals with a background in larger corporations are now more receptive to embracing risk, considering opportunities in smaller companies with the expectation of qualifying for enhanced long-term incentives. This strategic shift reflects a broader trend among executives seeking new challenges and rewards in the evolving professional landscape.

Team Structures

Team structures across various functions are evolving to meet the demands of a growing and innovative market, particularly in the commercial property and technology sectors, leading to potential expansions in team sizes. The focus is on enhancing the skills and capabilities of sales teams, reflecting the strategic importance of these functions. The increased prominence of Chief Growth Officer (CGO) roles is notable, with CGOs playing a crucial part in driving revenue growth, understanding market opportunities, and leading cross-functional teams. Key skills for CGOs include a visionary outlook, financial literacy, collaboration, change management, and industry-specific knowledge, with sectors like electric vehicles, hospitality, manufacturing, engineering, construction, oil, real estate, and banking actively hiring CGOs.

The role of Chief Commercial Officers (CCOs) is also evolving, with increased collaboration with CMOs in order to drive company revenue, building brands, and managing vast data and IT infrastructure. Strategic thinking, data analysis, digital marketing proficiency, and leadership are key skills and qualifications for leaders, who must also focus on creating seamless omnichannel experiences and leveraging new technologies like generative AI. Future trends indicate that generative AI will disrupt marketing functions, and lead generation tactics. This indicates an important opportunity and need for teams to upskill.

Skills in Demand

The rising importance of social skills in C-suite roles is evident as companies now prioritise these abilities over traditional operational expertise. High self-awareness, effective communication, empathy, and the capacity to work with diverse groups are key social skills that are becoming essential. However, assessing these skills presents challenges, necessitating new tools and approaches such as psychometric assessments and simulation exercises.

In terms of industry trends, sectors like financial services, distribution, digital media, MedTech, and professional services remain robust, while retail and large consumer tech are experiencing quieter periods due to the RBA’s impact on consumer confidence. Currently, there is a high demand for skills related to strategic growth and technological advancement. This demand underscores a shift towards positions that drive growth and innovation within organisations. Experience and industry knowledge, especially in the commercial property and technology sectors, are highly valued, as they are crucial for navigating competitive landscapes and implementing growth-oriented strategies.

Candidate Availability

As is consistent with the market, high level executive candidates that possess incredible leadership abilities with a robust commercial acumen are difficult to source. Now that they are significantly in demand due to the changing nature of the market it is imperative that organisations are working to showcase the value of the opportunities they have available. Due to an increase in demand we are seeing that candidates are open to a lot of opportunities in faster than normal processes in what is a candidate short environment.

Alexandra Mitcherson William Lukabyo

Chief Commercial Officers Chief Commercial Officers

Market Update

Mirroring the demands of the current economic landscape, most businesses have been through a significant exercise of ‘cost out’. Large organisations are revaluing their business units and returning to core operations to ensure they have an eye on cash flow and can weather this current period before rebounding when the economy returns to growth. Of course, the key advisor to this strategy is the CFO and their ability to look at data and make decisions has been critical.

We have seen slightly less CFO movement in FY24 than in prior years, this may be as a result of the value in their insights as a partner to the CEO. Median tenures of CFO’s have stepped up slightly from just 2 years during the pandemic to 2.8 years today.

Remuneration Trends

While CFO salaries in Australia have increased by 10 to 15 per cent in the last couple of years, the slowing market indicates there will be lower increases of up to 5 per cent for senior finance roles in 2024. The earning potential of a CFO depends largely on the size of their organisation. In the year of 2023, Australia’s top 200 company CFOs saw their median salaries spike by 24 percent to A$1.44 million. At the same time, median statutory pay for the top ASX 300 CFOs increased by 9 per cent to $1.14 million. Key financial trends, such as high inflation and rising household costs, may lead many executives to seek new roles in 2024.

Long term incentive plans for CFO’s are changing, with non-financial metrics becoming more prominent. Almost 40% of ASX100 companies include non-financial metrics in their CFO incentive plans and these include environmental, social and governance targets, sustainability targets, diversity and Inclusion measures, and customer and employee satisfaction scores. We are seeing the success of a CFO be measured through a blend of financial metrics, strategic achievements, and leadership effectiveness.

Over recent years we have seen significant salary increases for those finance executives in the mid-market, including increases of up to $20,000 to $40,000. Although more recently these increases have normalised.

Team Structures

In combination with being the advisor to the CEO on returning businesses to their core offerings and managing cost, CFOs are also focussing on being advocates for the attraction and retention of key talent. It has never been more critical to be an inspirational leader to the finance team during a time when the finance team is generally leaner and relied upon for more output and insights.

An ability to utilise technology to augment reporting and insights processes has been critical with many organisations looking to their CFOs for answers on how cost can be saved through the use of advanced systems and AI. This has led to an increased collaboration between the CFO and Chief Technology Officer to work together around common business goals.

The transactional roles within finance teams continue to be automated and offshored, leaving the local finance capabilities to focus on strategy, financial planning and analysis as well as future-focused goal setting and market preparedness.

Skills in Demand

We have seen a significant shift in the required capabilities for CFOs and this is in line with the changing business priorities. In prior years many CFOs were focused on growth plans, mergers and acquisitions, new product or service launches and long-term strategies. This year has seen a refocus on internal considerations including cost and risk management, investor relations and articulating business strategy to external stakeholders. We expect this trend to continue into FY2025.

Candidate Availability

As has always been the case, the very best talent in the finance function continues to remain in high demand and very difficult to source. In FY20204 we found that those‘future-focused’ finance executives, being those with very strong forecasting, data insights and FP&A skills, have tended to be well embedded in their organisations, are less accessible and less willing to move. The key to accessing this talent has been to build a compelling career narrative and provide insights into how they can pave the foundations for their eventual step into the CFO role.

Michael Carlino

Chief Financial Officers

Market Update

As businesses attempt to navigate the current economic environment they have been more willing to incentivise success through the provision of ‘at risk’ components of salary such as long and short term incentives. These schemes have generally become more transparent with an objective scorecard that reflects a combination of business and individual success.

Executives are finishing up their projects and now it is a business as usual situation where they are not finding the work challenging enough. Those who have been working in an industry for a significant amount of time are increasingly motivated to change industries. C-Suite/Lead roles specifically in cybersecurity this year involve the building of teams which have not existed in the past or continue to build on existing teams as the risk of cybersecurity attacks increases by the minute.

Team Structures

As restructuring is occuring, many teams are becoming leaner and this is often motivated by cost cutting. This trend is apparent in organisations of various sizes. We have spoken with global companies in various sectors about this with one global healthcare company indicating their technology team was made up of under 10 people.

The blurring of lines between CIO and CTO positions are becoming more and more apparent. In the past, part of a CTOs remit has included covering part of the cybersecurity capability. Now, organisations are hiring dedicated cybersecurity specialists to cover the entire capability. Some organisations have created cybersecurity capabilities that are broken up into parts such as incident response, resilience and governance.

Blurring of lines between title use is becoming more prevalent. For example, CTO and CIO responsibilities have shifted (e.g. now companies want executives who can undertake both inward and outward facing responsibilities). Also, certain companies will have different titles for those who are at the top leadership positions such as Principals and Managing Directors.

Skills in Demand

Executives who have in-depth insight and skills in cybersecurity and artificial intelligence are highly sought after. Regarding industry, some organisations still want their leadership teams to be made up of executives coming from the same industry. However, most of our clients have an industry agnostic and function first view when bringing executives onto their leadership team.

Candidate Availability

Due to the candidate heavy market, candidates of all levels are available. Additionally, diversity is becoming even more of a focus for companies and they are ensuring that this is something that is adhered to. As such, we can provide a variety of talent to meet client needs.

Amaraj Bansal

Chief Digital & Technology Officers

Market Update

In the current economic climate a lot of sectors are focused on doing more with less; whether optimising performance of their workforce, downsizing or reducing cost, or looking to their leaders to drive engagement and productivity.

Talent assessment and identification – Organisations are ensuring they are clear on the behavioural capabilities needed to deliver competitive advantage, and putting in place robust and objective assessment processes to identify key talent.

Organisational design – Many companies are reviewing their organisational structures to ensure resources are effectively deployed and costs minimised. This is tending to lead to more centralised structures with a focus on standardisation and reduced duplication, rather than devolved authority and empowerment of local managers.

Leadership development – Fewer clients are designing large cohort-based leadership programs, with more interest in structured activity to build specific leadership capabilities, either with intact teams or individually through executive coaching.

Team Structures

Agile continues to gain traction with more and more organisations incorporating agile elements into their organisational structures.

Squads, tribes and chapters are increasingly common, with team and organisational structures shifting. Interestingly, while the language used often reflects agile principles, the structures and working practices are less different.

Elsewhere, the shift to skills-based operating models continues to gain lots of attention. Again though, it’s worth separating the noise from the reality; what many organisations are claiming as a transformational shift in thinking is often little more than a – very sensible – focus on defining, building and measuring relevant skills and capabilities.

Leadership Skills in Demand

Whether we call it “adaptive leadership”, “learning agility” or something else, the focus for some time has been on building small “A” agility as a key leadership capability. In simple terms, helping leaders know the questions rather than the answers will equip them to lead their organisations and teams through uncertain and fast-moving change.

Closely linked to this, we are of course seeing organisations wrestling with how to take advantage of AI and other technology advances; huge potential but still relatively untested, and while it’s a frequent conversation topic, there are few organisations yet to operationalise the technology in any meaningful or measurable way.

Key & Interesting Projects

Top team effectiveness – We have been working with the leadership team of a large government department to help them define how best to work together, lead their teams, and the department overall. This includes some individual and team assessment, executive coaching and also support onboarding new team members.

Strategy reset – Working with a large healthcare provider to onboard two acquired companies, we’re co-designing and delivering a series of strategy workshops. These are intended to help align leaders on the post-acquisition priorities and also to agree the leadership behaviours that will be key to a successful integration.

Executive coaching – At the heart of what we have done for some time, we continue to provide individual and team coaching to a series of C-suite leaders and their teams, helping define and tackle issues such as team purpose and performance, and at an individual level to set leaders up for future success in the long term.

Murray Priestman

Talent Consulting Associate

EMERGING TRENDS

Executive Talent Landscape

As we reflect on the past financial year, several emerging trends have shaped the executive search landscape. Here are the key developments we have observed:

- Agile Leadership: Rising demand for leaders with agile management skills to navigate rapidly changing market conditions;

- Cybersecurity: Heightened awareness and investment in cybersecurity measures to protect against increasing cyber threats;

- Technology Integration: Increased adoption of AI and automation tools to streamline business operations and improve decision-making processes;

- Personalised Customer Experience: Shift towards personalised customer engagement strategies, leveraging data analytics to better understand and meet customer needs;

- Upskilling and Reskilling: Investment in upskilling and reskilling programs to ensure the workforce remains competitive in a dynamic market;

- Remote Work Evolution: Continued refinement of remote work policies and infrastructure to support a hybrid workforce; and,

- Employee Well-being: Enhanced focus on mental health and well-being programs to support employee productivity and retention.

Evolving Trends

As we move into the new financial year, we anticipate continued strong demand for executive talent, driven by several key factors:

- Agility and Adaptability: The rapidly changing business environment requires agile leaders who can pivot strategies and manage change effectively;

- Economic Resilience: Businesses are demonstrating resilience and adaptability, focusing on strategic growth initiatives despite economic uncertainties;

- Technological Advancements: Increased adoption of AI, machine learning, and automation is transforming business operations and driving digital innovation;

- Global Talent Acquisition: The shift to remote and hybrid work models has expanded the talent pool globally, necessitating expertise in managing diverse teams;

- Focus on Sustainability: Companies prioritise sustainability and ethical practices, seeking leaders who can align these initiatives with business goals; and,

- Diversity and Inclusion: There is a growing demand for leaders who can foster a culture of diversity and inclusion, driving better business outcomes.

OPPORTUNITIES & EVENTS

EXECUTIVE LEADERSHIP EVENT SERIES 2024

Each quarter, Pacific Talent Partners has been delighted to host exceptional Executive Leadership Events at prestigious venues like The Hilton Hotel and The Langham Hotel in Sydney. We assemble a distinguished panel of executive speakers who share their insights on various topics, fostering meaningful connections within our executive network. Here are some highlights of this year's successful events.

This morning, Pacific Talent Partners were delighted to host another extraordinary Executive Leadership Series Event at The Hilton, Sydney…

This morning, Pacific Talent Partners were delighted to host another extraordinary…

This morning, Pacific Talent Partners were delighted to host our last Executive Lea…

WELCOME TO THE TEAM

At Pacific Talent Partners, our guiding purpose is to maximise potential and with this in mind we are delighted to introduce some of the new additions to our consulting and operations teams.

Michael Perugini

UX/UI Designer

Monique Wijesekera

Operations Assistant

Amaraj Bansal

Practice Lead | Digital & Technology Officers

Lachlan Kanaan

Consultant | Research

Mateo Villa

Consultant | Research

Harry Jeffery

Consultant | Research

RECOGNISING SUCCESS

We are thrilled to celebrate the well-deserved promotions of our consulting teams.

William Lukabyo

Commercial Officers Practice

Alexandra Mitcherson

Commercial Officers Practice